Category: Analyst Decoder Ring

Posted Date:

-

The Crazy Upside for Nvidia

Nvidia talked about an installed TAM base growing from $1 Trillion to $2 Trillion over the next five years. We did the math to see what that means.

-

Nvidia Q4 Results: More Acceleration

Nvidia now accounts for 75% of the market for data center processors. They are the most important company in the market now. How well the stock can do now is a totally…

-

Revenge of the CFO – AI Edition

What does the proverbial Box Company need AI for right now? For non-technical companies is now the right time to invest in AI systems or is better to wait until the technology…

-

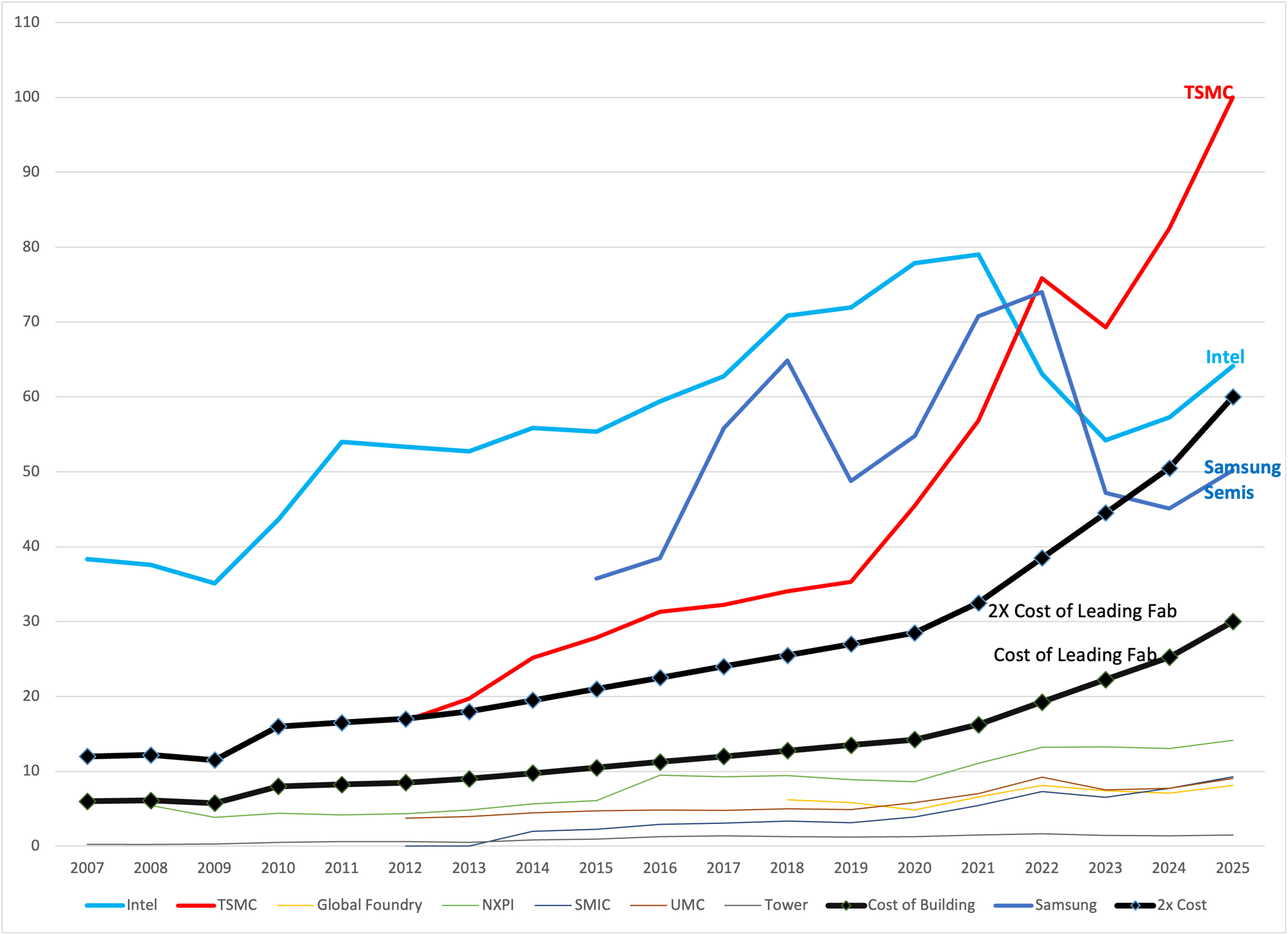

Keeping up with the Li’s

To stay competitive in leading edge semis fabs, companies need to generate roughly double the cost of a fab in revenue. By this math Intel is cutting it pretty closely. It also…

-

How (Un)Profitable will IFS Be?

We tried to model IFS revenue ahead of their event next week. There are many unknowns, especially how the company allocates costs internally. But from our very rough math, IFS looks like…

-

Arm Results Set the World on Fire

Arm’s results go a long way to establishing the company’s credibility with the Street. Solid execution and some strong tailwinds are helping. That being said, the company’s valuation is pushing into Priced…

-

Qualcomm is doing OK

Qualcomm had a good quarter. Signing a multi-year deal with Samsung, which removes an overhang. And sounding fairly upbeat about actually seeing meaningful auto revenue this year.

-

Backing NVDA’s numbers out of TSMC

Some back of the envelope math. Backing out Nvidia’s numbers from TSMC’s results point to a good quarter from Nvidia, possibly a very good one.

-

Among the ruins – Intel mishandles its latest quarter

Intel’s seriously mis-communicated their very soft Q1 guidance. They sounded like a company with 90% market share in addressing their outlook, not one with 40%.

-

ERIC in Charge

AT&T’s deal with Ericsson providers them with a big discount, but risks putting Ericsson in the driver’s seat for O-RAN, short circuiting the strategic leverage AT&T seeks with its “open” network. AT&T…